SurePayroll allows users to process payroll online, manage employee information, and handle tax compliance from a single system. The product is positioned for small businesses that need a straightforward payroll solution without the complexity of enterprise HR platforms. In addition to business payroll, SurePayroll also offers services for household employers, including nanny and caregiver payroll, making it suitable for non-traditional employment scenarios.

Users enter employee details, pay rates, and schedules into SurePayroll. The system calculates wages, deductions, and taxes automatically. Payroll can be run on a scheduled or manual basis, with taxes filed and paid on the employer’s behalf. Employees access pay stubs and tax documents through a self-service portal.

Strong tax filing and compliance handling.

Employee self‑service portal reduces admin calls.

Good fit for small firms and households.

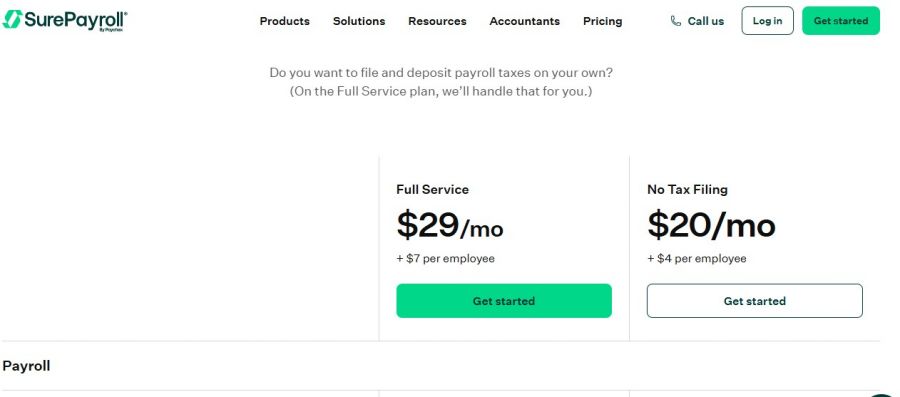

Pricing competitive for low headcounts.

Customer support quality highly inconsistent.

Website navigation confusing when issues arise.

Risk reviews can suddenly pause payroll.

30 Days

No

Proprietary

*Check the current pricing on SurePayroll's website.