On This Page

- Founding and Growth: How Placer.ai Rose to Prominence

- Core Capabilities and Platform Features

- Table: What Placer.ai Provides and How It Is Used

- Real World Examples and Customer Impact

- Strengths and Weaknesses of Placer.ai

- Notable Alternatives to Placer.ai

- Table: Leading Alternatives to Placer.ai

- Recent Developments and Industry Position

- Overall Assessment of Placer.ai

Placer.ai has become one of the most influential tools in the location intelligence industry by turning real-world movement into measurable insights. Instead of relying on assumptions or traditional survey data, the platform uses anonymized mobile location signals, machine learning, and geospatial modeling to illustrate how people move through physical spaces. This review explores its history, capabilities, impact, and limitations in a format designed to clarify what Placer.ai truly offers.

Founding and Growth: How Placer.ai Rose to Prominence

Placer.ai was founded in 2016 in Los Altos, California by Noam Ben Zvi, Oded Fossfeld, Ofir Lemel, and Zohar Bar Yehuda. The team recognized a gap in traditional market research, which often relied on outdated or incomplete information about offline behavior. Their goal was to build a platform that captures real visitation patterns across retail, commercial real estate, hospitality, civic planning, and other sectors, while still preserving user privacy through strict anonymization practices.

From its first pre seed round in 2016, Placer.ai expanded rapidly. It attracted growing investor interest through several funding rounds, including a 12 million dollar Series A in 2019. The breakthrough moment arrived in January 2022 when the company secured 100 million dollars in a Series C round that pushed its valuation to 1 billion dollars, officially placing it in the unicorn category. Momentum continued through 2024, when Placer.ai raised another 75 million dollars, raising its valuation to 1.5 billion dollars. During the same period, the company announced that it surpassed 100 million dollars in annual recurring revenue, which reflected widespread industry adoption.

By 2024 and 2025, Placer.ai had become a recognized authority in foot traffic analytics and was used in thousands of businesses across various industries.

Core Capabilities and Platform Features

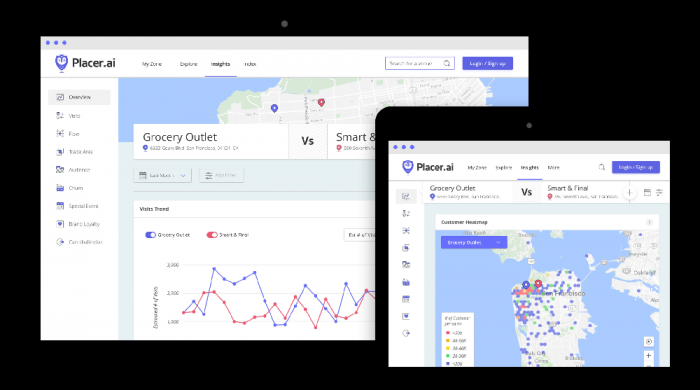

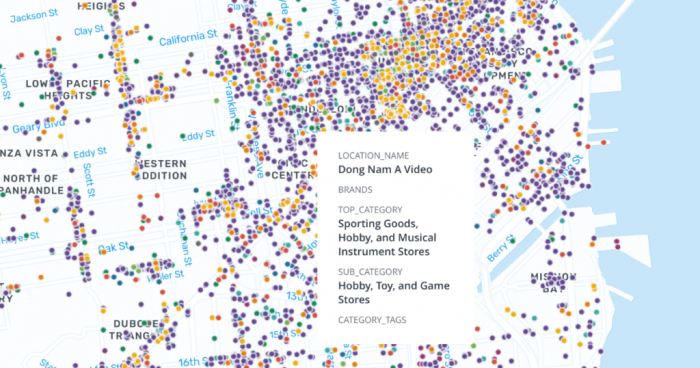

Placer.ai offers a suite of tools capable of analyzing movement patterns in the physical world. At the center of the platform is its ability to transform mobile location signals into insights about visitation patterns. These insights include visitation counts, dwell times, demographic characteristics, competitive benchmarking, and trends across time. The technology is supported by proprietary geofencing, property polygons, and machine learning models that help refine accuracy.

Placer.ai also allows clients to integrate data into business workflows through dashboards, APIs, and data feeds. Many organizations use the tool for site selection, marketing optimization, portfolio performance monitoring, and risk assessment. As the platform evolves, it continues to add new layers of data such as consumer behavior trends, psychographics, web traffic indicators, and purchase data.

Below is an overview of what the platform delivers.

Table: What Placer.ai Provides and How It Is Used

| Feature | Description | Primary Users |

| Foot Traffic Analytics | Tracks visits by hour, day, or longer timeframes and identifies seasonal or event driven trends | Retailers, real estate firms |

| Trade Area Analysis | Maps where visitors originate and identifies demographic and behavioral traits | Mall operators, store planners |

| Competitive Insights | Compares one brand or location with others in the same market | CPG companies, retail analysts |

| Portfolio Monitoring | Tracks performance across multiple properties or locations | Commercial real estate owners |

| API and Data Feeds | Integrates visitation data with BI tools or custom dashboards | Data science teams, enterprise clients |

| Predictive and Forecasting Layers | Uses historical traffic patterns combined with additional datasets to support strategic decision making | Investors, urban planners |

These capabilities make the platform highly valuable for companies needing clarity about how people behave in physical environments.

Real World Examples and Customer Impact

Placer.ai serves over 4,000 customers across industries including commercial real estate, retail, consumer brands, hospitality, and government agencies. Case studies highlight a wide range of applications. For example, Banner Health used Placer.ai to evaluate expansion decisions, which helped reduce planning timelines and operational costs. The New York Blood Center improved facility performance by using trade area segmentation to match services with community behavior.

Retail chains have used Placer.ai to refine ad targeting and to measure the effect of campaigns on store visits. In another case, Webster Bank analyzed branch visitation trends to strengthen risk management for its portfolio. Discover Kalamazoo used the platform to support tourism initiatives, and a 2025 partnership with Old Town, Maine demonstrates Placer.ai’s growing presence in civic innovation. These examples show that the platform is not only a data tool but a practical engine for decision making in the physical economy.

Strengths and Weaknesses of Placer.ai

Although Placer.ai has cemented itself as a leader in location intelligence, its model comes with both advantages and limitations. The following section outlines its strongest attributes and the areas where users should exercise caution.

Strengths and Advantages

● Behavior based insights instead of opinion based surveys which increases accuracy

● Scalable comparisons across thousands of locations regardless of geography

● Integration with popular business intelligence systems which simplifies adoption

● Strict privacy practices that rely on anonymized and aggregated data

● Breadth of industry applicability making it versatile for retail, real estate, civic planning, and more

Limitations and Caution Areas

● The platform depends on mobile device data, which may underrepresent populations with limited smartphone usage

● Panel bias can occur if certain demographic groups share location data at higher rates than others

● Subscription costs may be substantial for smaller organizations

● Users may incorrectly assume that high foot traffic equals high sales, which can lead to misleading conclusions

● Increasing global scrutiny of location data may create regulatory uncertainties

These factors do not diminish the value of Placer.ai, but they highlight why it should be used thoughtfully rather than as a sole source of truth.

Notable Alternatives to Placer.ai

While Placer.ai is one of the most recognizable names in foot traffic and location analytics, it is not the only option available. Several platforms offer comparable datasets or specialize in areas where Placer.ai may not be the ideal fit. These alternatives provide different approaches to location intelligence, ranging from device-level mobility data to POI mapping and demographic enrichment.

Table: Leading Alternatives to Placer.ai

| Platform | Core Strength | Ideal Use Case |

| SafeGraph | High-precision Points of Interest (POI) data and building footprints | Companies that need accurate POI mapping and deep property-level datasets |

| Foursquare Analytics | Strong mobility panels and long-standing expertise in consumer movement patterns | Brands and agencies that prioritize consumer behavior modeling and trend forecasting |

| Precisely (Places) | Large, curated global POI catalogue and data enrichment with enterprise distribution (Snowflake, etc.). | Enterprises requiring global POI coverage, data hygiene, and enterprise data pipeline integration. |

Each of these platforms offers a different angle on location intelligence. SafeGraph focuses on POI accuracy, which supports use cases that require precise venue polygons. Foursquare has a long history in mobility analytics and delivers strong behavioral trend insights. Near Intelligence emphasizes cross-channel signals, giving marketers a broader understanding of audience composition and movement.

These alternatives provide meaningful options for organizations evaluating Placer.ai or seeking complementary datasets to enrich their analysis.

Recent Developments and Industry Position

During 2025, Placer.ai continued expanding its analytics ecosystem by incorporating new datasets and improving predictive features. It also released updates related to office visitation in the United States, where traffic remained below pre pandemic levels but continued improving. The company faced challenges as well, including a workforce reduction of roughly 18 percent in early 2025 to align with profitability goals during shifting market conditions.

Despite these adjustments, Placer.ai appears committed to broadening its capabilities, strengthening partnerships, and advancing privacy focused AI technologies. Its competitive landscape includes companies such as SafeGraph and Foursquare, but its combination of real-time analytics, trade area modeling, and enterprise grade reporting has helped it maintain a strong position.

Overall Assessment of Placer.ai

Placer.ai is a powerful tool that brings visibility to the offline world in a way that traditional analytics cannot replicate. Organizations that rely on precise understanding of human movement can benefit significantly from the platform’s depth and accuracy. Users should still balance Placer.ai insights with additional sources of data to avoid oversimplified interpretations, but the value it provides is substantial.

The platform is most effective for organizations that operate physical spaces or have investments tied to location performance. For anyone seeking reliable, privacy conscious, real world analytics based on actual human behavior, Placer.ai has proven to be one of the leading solutions in the industry.

Post Comment

Be the first to post comment!