On This Page

- What is Yrefy?

- What Do Yrefy Investors Say?

- Reddit: Skepticism and Red Flags

- Bogleheads Forum: High Returns = High Risk?

- Clark.com Forum: Curious but Cautious

- Trustpilot and BBB: Mixed but Mostly Positive

- Glassdoor Reviews: What Employees Think

- Independent Reviews: What the Experts Say

- LendEDU: Good for Borrowers, Not Rated for Investors

- NerdWallet and SuperMoney: Missing Yrefy from Ratings

- Media Coverage: What Does the Press Say?

- Pitchbook: A Private, Niche Company

- EducationData and The College Investor: A Mixed Bag

- ScamAdviser Check: Is Yrefy a Scam?

- Should You Invest in Yrefy?

- Final Thoughts: Is Yrefy Right for You?

Is Yrefy a Smart Investment or a Risky Bet?

If you've heard of Yrefy through radio ads or online chatter, you're not alone. The company is marketing hard—especially to investors looking for high, fixed income returns. But what exactly is Yrefy? Is it legit? And more importantly—does it deliver what it promises?

In this blog, I’ve done a deep analysis of all major Yrefy reviews—from investor forums to third-party financial sites. I’ll walk you through the facts, real user experiences, expert reviews, and financial ratings.

What is Yrefy?

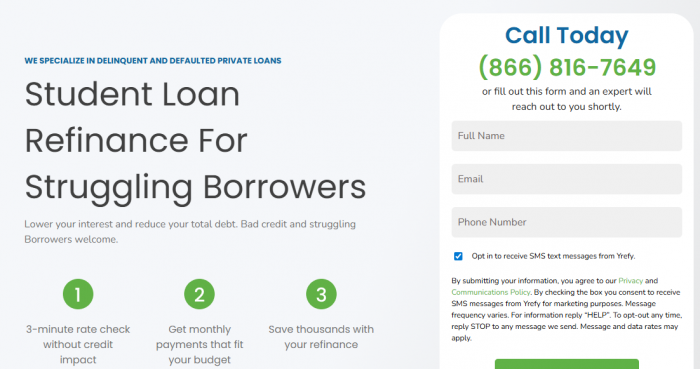

Yrefy LLC is a private investment company based in Phoenix, Arizona. It provides capital to refinance defaulted private student loans. This means it targets borrowers who typically can't get refinancing through traditional lenders.

Rather than selling to institutional investors, Yrefy lets individual accredited investors fund these loans and earn fixed returns between 7.5% and 10.25%.

Their official site, Yrefy.com, calls it an “impact investment”—claiming to help students rebuild their credit while offering passive income to investors.

But high returns in finance almost always mean higher risks. So let’s unpack what real people and financial experts are saying.

What Do Yrefy Investors Say?

Reddit: Skepticism and Red Flags

A revealing Reddit thread on r/investing shows multiple users raising red flags. Some highlights:

- One user questioned why Yrefy is advertising so heavily on talk radio—a platform often used by less regulated financial products.

- Another pointed out the absence of regulatory oversight, specifically with FINRA or the SEC.

- A few users mentioned it reminded them of pre-2008 subprime lending models.

The consensus? It sounds appealing, but it requires serious due diligence.

Bogleheads Forum: High Returns = High Risk?

Over on Bogleheads, the tone was even more cautious. A few key points from that thread:

- Investors questioned the lack of transparency around Yrefy’s business model.

- There were concerns about default rates, collateral, and what recourse investors have if things go south.

- A user said bluntly: “If it’s paying 10%, it's because nobody else wants to touch it.”

The Bogleheads community generally avoids non-traditional or opaque investment vehicles. This puts Yrefy firmly in the "speculative" category for many of them.

Clark.com Forum: Curious but Cautious

In the Clark.com community, one user shared that a friend was earning 9.5% and was happy—until they dug into the risks.

- Yrefy isn’t FDIC-insured.

- If the company goes bankrupt, investors lose access to cash flow from their promissory notes.

- The company is privately held, and there's no secondary market for these notes.

- Again, the interest rate is attractive, but liquidity and transparency are major concerns.

Trustpilot and BBB: Mixed but Mostly Positive

Looking at consumer-facing platforms:

- On Trustpilot, Yrefy has a rating of 3.2 out of 5 stars.

- Most reviews mention excellent customer service and strong communication.

- Several borrowers praise Yrefy for refinancing their defaulted student loans and helping them repair their credit.

However, keep in mind that Trustpilot reviews can be curated. They're helpful, but shouldn’t be your only source.

The Better Business Bureau (BBB) lists Yrefy as accredited, with an A+ rating and few complaints. That’s notable and does indicate legitimacy in customer service.

Glassdoor Reviews: What Employees Think

Glassdoor reviews reveal an internal culture that’s very sales-driven.

- Current and former employees report aggressive quotas and a focus on marketing.

- Some praise leadership and compensation, while others mention a lack of long-term strategy.

This aligns with the heavy radio and online marketing strategy seen by many potential investors.

Independent Reviews: What the Experts Say

LendEDU: Good for Borrowers, Not Rated for Investors

LendEDU’s review focuses more on the borrower side:

- Yrefy helps borrowers who’ve defaulted and can't qualify for federal loan forgiveness or refinancing.

- They do not require a credit score, and offer fixed interest rates.

- However, there's little discussion about investor protection.

LendEDU positions Yrefy as an option for hard-to-qualify borrowers, not a mainstream investment vehicle.

NerdWallet and SuperMoney: Missing Yrefy from Ratings

While NerdWallet does list Yrefy in its database, it does not give it a rating or full review—possibly due to lack of financial disclosure or limited user data.

SuperMoney’s review and another version on student loan refinancing give Yrefy an overall 4-star rating, praising:

- A unique model that helps student borrowers post-default.

- Transparent rates for borrowers.

Again, these reviews mostly reflect the borrower experience—not investor risk.

Media Coverage: What Does the Press Say?

According to Yahoo Finance, Yrefy claims to be addressing a $4.5 billion segment of the student loan market that's largely ignored by traditional lenders.

Their approach? Help borrowers out of default while offering investors a piece of the repayment pie.

But Yahoo also notes that Yrefy isn't regulated by the SEC, nor do they offer public filings, making transparency a challenge.

Pitchbook: A Private, Niche Company

Pitchbook’s company profile lists Yrefy as a privately held firm founded in 2016. It notes limited funding rounds and no major institutional backers—meaning retail investors are the core financial engine.

This raises two questions:

- What happens if investor interest dries up?

- Is the business model sustainable long-term?

EducationData and The College Investor: A Mixed Bag

EducationData.org notes that Yrefy fills a critical gap in the market. They serve a niche of students often left out of the credit system entirely.

Meanwhile, The College Investor goes deeper into investor concerns:

The site highlights a lack of liquidity, no secondary market, and potential regulatory risks.

It concludes that Yrefy could work for income-focused accredited investors—but only after deep due diligence.

ScamAdviser Check: Is Yrefy a Scam?

ScamAdviser scores Yrefy.com as “safe” with a trust score of 86.

Still, that only means the site is secure and has a good reputation online—it doesn’t account for investment risk or solvency.

Should You Invest in Yrefy?

Here's a summary of what I’ve found across 20+ sources:

| Factor | Rating / Insight |

| Transparency | Low – No SEC filings or audited financials |

| Return on Investment | High (7.5%–10.25%) – but not guaranteed |

| Liquidity | Very Low – No early exit or secondary market |

| Regulatory Oversight | None – Not registered with SEC or FINRA |

| Borrower Impact | Positive – Helps borrowers out of default |

| Investor Protection | Weak – Investors hold promissory notes |

| Online Reputation | Mostly positive with cautious investor sentiment |

Final Thoughts: Is Yrefy Right for You?

Yrefy offers a compelling story: help struggling student borrowers while earning double-digit returns.

But it comes with real, material risks. If you’re an accredited investor and understand how private notes work—this may be worth exploring.

However, for most people, especially those seeking low-risk, liquid investments, Yrefy may not fit the bill.

If you’re still considering it, start by reading the full investor disclosures at investyrefy.com and request performance data. Never invest based on radio ads or hearsay alone.

Jon Whiteman

Nov 11, 2025I was a former senior partner at Deloitte. I've audited major corporations worldwide, like Dow, and most of General Motors, several banks, and was National Chairman of Mortgage Banking. I ended my career by managing multi-billion leveraged buyouts. I was also an SEC Professional Accounting FelIow. The prevalence of yrefy ads all over TV, even in the background when Erika Kirk was speaking, and a BBB rating that makes no sense (and for other companies as well), forced me to investigate them, limited by my phone or computers. They are not a public company or registered with the SEC. I searched for their audit firm, and found it. A specialized BS firm. I texted them requesting yrefy's last annual report, and heard nothing back. I do not believe that yrefy is acting under the law. They are an investment company and a bank. Their Financials SHOULD BE PUBLIC, supported by independent audits by an accredited CPA Firm.