On This Page

- What Trend Following Claims to Do

- How Trend Following Performs in Reality

- Does Trend Following Still Work in Modern, High-Speed Markets?

- The Role of Discipline: Where Most Traders Break the Strategy

- Risk Profile: What Trend Following Protects You From, and What It Doesn’t

- Public Reputation vs Reality

- Education, Influencers, and the Michael Covel Effect

- Who Trend Following Is Actually Suitable For

- Review Scorecard: Trend Following as a Trading Strategy

- Final Verdict

Trend following is often presented as one of the few trading strategies that has survived decades of market change. It appears in academic research, hedge-fund literature, and the work of well-known traders. At the same time, it is frequently misunderstood by retail traders who expect fast results or consistent monthly gains.

This review looks at trend following not as a philosophy, but as a trading approach in practice, how it behaves in real markets, what it does well, where it fails, and whether it realistically fits modern traders in 2026.

What Trend Following Claims to Do

At its core, trend following claims a simple objective:

participate in large market moves while strictly controlling losses.

Rather than predicting price direction, the strategy waits for confirmation that a market is already moving and then attempts to stay in that move until it weakens. This logic has been documented both academically and historically, including by sources such as Encyclopaedia Britannica.

The appeal is obvious. If markets trend more often than they reverse instantly, then a systematic approach that follows those trends should, in theory, benefit over time.

However, claims alone are not enough. A strategy must be judged by how it behaves under stress, not how it sounds in theory.

How Trend Following Performs in Reality

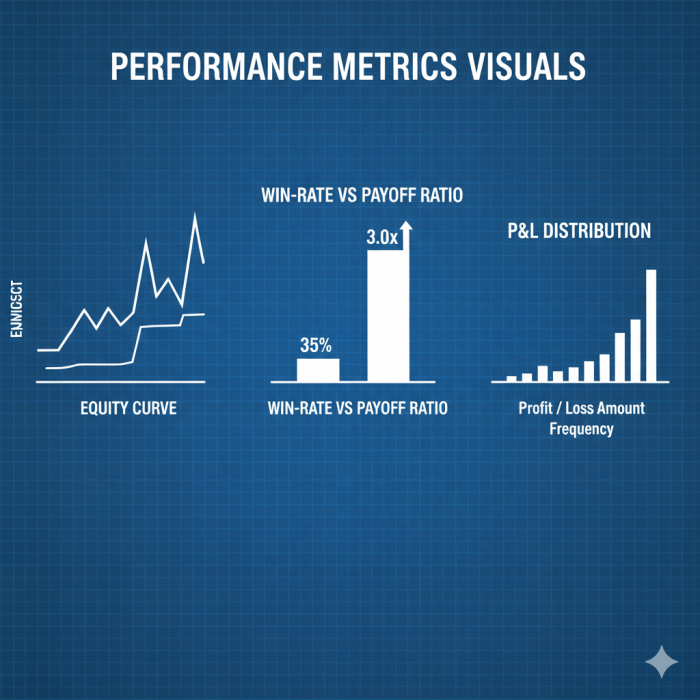

One of the most important realities of trend following is that most trades lose money. This surprises many new traders.

A typical trend-following system may have:

- a win rate between 30%–45%

- many small losing trades

- a few very large winning trades

The entire performance depends on whether those few winners are large enough to offset the repeated losses.

This means performance is uneven and lumpy, not smooth. There can be long periods where nothing seems to work, followed by a short window where trends dominate and profits appear rapidly.

From a review standpoint, this is both a strength and a weakness:

Strength: it avoids catastrophic losses when risk rules are followed

Weakness: it tests patience more than most strategies

Does Trend Following Still Work in Modern, High-Speed Markets?

A common criticism is that trend following worked “in the past,” but not in today’s algorithm-driven markets.

In reality, what has changed is expectations, not market behavior.

Trends still emerge because:

- institutions scale positions slowly

- large funds cannot enter or exit instantly

- fear and greed still drive delayed reactions

What has changed is that trends can be shorter and more fragmented, which means systems must be well-designed and diversified across markets.

Trend following still works best when applied to:

- multiple asset classes (stocks, futures, currencies, commodities)

- longer timeframes (daily or weekly, not intraday noise)

- strict position sizing rules

Applied narrowly or emotionally, it fails quickly.

The Role of Discipline: Where Most Traders Break the Strategy

From a reviewer’s perspective, trend following rarely fails because the idea is wrong. It fails because humans intervene.

Common breakdown points include:

- stopping the system after a losing streak

- reducing position size right before a major trend

- over-leveraging during good performance

- adding discretionary filters that destroy consistency

Trend following is unforgiving to inconsistency. Either the rules are followed fully, or the edge disappears.

This is why many professionals treat it as a process, not a tactic.

Risk Profile: What Trend Following Protects You From, and What It Doesn’t

Trend following is often praised for its risk management, and rightly so. It is designed to:

- limit losses on individual trades

- avoid large drawdowns from single positions

- benefit during extreme market moves (crashes, crises, runaway trends)

However, it does not protect against:

- long periods of underperformance

- psychological fatigue

- opportunity cost during sideways markets

In other words, trend following manages market risk well, but exposes traders to emotional and patience risk.

This distinction is often ignored in surface-level discussions.

Public Reputation vs Reality

Public perception of trend following is polarized.

Supporters point to:

- decades of performance evidence

- successful hedge funds and CTAs

- documented traders and systems

Critics often cite:

- long drawdowns

- lack of excitement

- underperformance during quiet markets

User reviews, including mixed feedback seen on platforms like Trustpilot for trend-following education providers, often reflect expectation mismatch, not strategy failure.

People expecting frequent wins are disappointed. Those expecting long-term asymmetry tend to stay.

Education, Influencers, and the Michael Covel Effect

Much of modern awareness of trend following comes from the work of Michael Covel, whose books and podcast documented both the strategy and the traders behind it.

Covel’s approach intentionally strips away:

- fundamentals

- predictions

- market narratives

- short-term thinking

For some, this clarity is refreshing.

For others, it feels uncomfortable or incomplete.

From a review standpoint, his work succeeds in accurately representing the difficulty of the strategy, which is rare in trading education.

Who Trend Following Is Actually Suitable For

Based on performance behavior and risk characteristics, trend following is best suited for:

- traders who value survival over excitement

- investors with long time horizons

- systematic thinkers comfortable with rules

- those seeking diversification rather than constant returns

It is poorly suited for:

- traders who need frequent validation

- short-term speculators

- people uncomfortable with drawdowns

- anyone unwilling to trade multiple markets

This alignment matters more than intelligence or capital.

Review Scorecard: Trend Following as a Trading Strategy

Strategy Evaluation (Out of 10)

| Category | Score | Review Rationale |

| Historical Credibility | 9 | Decades of documented use |

| Risk Management | 8 | Strong loss control by design |

| Consistency of Returns | 4 | Highly uneven performance |

| Psychological Difficulty | 3 | Emotionally demanding |

| Scalability | 9 | Works across markets & size |

| Ease of Learning | 5 | Simple rules, hard execution |

| Suitability for Retail Traders | 6 | Depends heavily on discipline |

| Long-Term Viability | 8 | Still relevant in modern markets |

Overall Strategy Rating: 6.5 / 10

Final Verdict

Trend following is not outdated, but it is not easy.

It remains one of the few trading approaches built on accepting uncertainty rather than fighting it. Its strength lies in risk control and asymmetry, not prediction or precision.

For traders willing to endure boredom, drawdowns, and delayed gratification, it can be a durable framework. For those seeking excitement, certainty, or fast feedback, it often becomes a source of frustration.

As a trading strategy, trend following deserves respect, but only when understood honestly, without shortcuts or unrealistic promises.

Post Comment

Be the first to post comment!