On This Page

- 1. Understand the Basics of Overseas Health Cover

- 2. Check the Destination’s Healthcare System

- 3. Look for Comprehensive Coverage

- 4. Compare Plans to Find the Best Deal

- 5. See for Pre-Existing Conditions

- 6. Know the Policy’s Limitations

- 7. Consider Additional Coverage for Special Activities

- Secure Your Health, Enjoy Your Adventure!

One of the most important things to think about before heading abroad is health insurance. Many individuals forget how important it is to have health cover while overseas. Without health insurance, unexpected medical expenses can become a big issue. In this article, you will learn the must-know tips that will help you ensure that your health cover is taken care of, no matter where your trip leads.

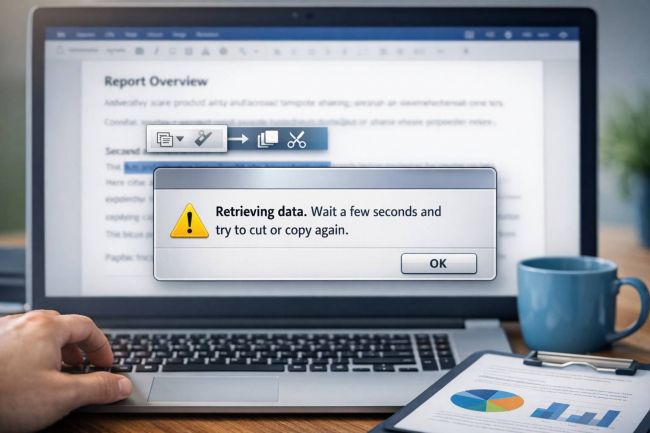

Interestingly, the importance of having the right systems in place to manage healthcare, whether at home or abroad, applies to providers as well. This article on why practice management software is essential for healthcare highlights how streamlined systems can reduce risk and improve patient care, especially when coordination across borders or facilities is involved.

To begin protecting yourself effectively while travelling, let’s start with the fundamentals.

1. Understand the Basics of Overseas Health Cover

Keep in mind that overseas visitor health cover provides protection for unexpected medical situations. This insurance can help you pay for things like doctor visits, hospital stays, and emergency treatments while traveling. Be sure to check the policy carefully to know exactly what is included. Some plans may also cover things like lost luggage or trip cancellations, which can be helpful in certain situations.

2. Check the Destination’s Healthcare System

In some countries, healthcare is expensive, especially for tourists, while in others, it’s more affordable. Before purchasing a policy, it’s helpful to research the healthcare costs in the destination country. This way, it will give you a better idea of the coverage needed. However, if traveling to a place where medical care is costly, it may be a good idea to go for a comprehensive plan.

Before selecting a plan, review government health sites like CDC Travelers' Health or NHS travel advice to understand regional risks and healthcare access.

3. Look for Comprehensive Coverage

Take note that it is essential to consider a comprehensive plan that protects against a wide range of situations. A good policy should cover emergency medical treatment, hospital expenses, and the costs of repatriation if someone needs to be transported back home for medical reasons. Most plans also cover the costs of medical evacuation if needed, which is important in any part of the world.

4. Compare Plans to Find the Best Deal

Prices and coverage vary, so it’s worth taking time to find the best deal. Don’t settle for the first option that appears. Look for a plan that provides the best balance of cost and coverage, just like the Allianz overseas visitor health cover. In addition to that, using an online comparison tool makes it easy for you to review the different policies and find one that fits your budget and travel needs. (Source: oshcaustralia.com.au)

5. See for Pre-Existing Conditions

Many health insurance plans have specific rules regarding pre-existing medical conditions. If there’s a condition that requires treatment, it’s vital to inform the insurance provider before purchasing coverage. Lots of policies exclude pre-existing conditions or charge higher premiums for coverage. However, certain plans are designed specifically for those with medical conditions and offer better coverage.

6. Know the Policy’s Limitations

The policy’s coverage limit is the maximum amount the insurance will pay for medical expenses. If the cost of care exceeds the policy’s limit, the traveler will need to pay the difference out of pocket. Make sure to learn what the coverage limit is before buying the policy. Remember, a higher coverage limit is often worth considering, especially if traveling to a country with expensive healthcare.

7. Consider Additional Coverage for Special Activities

Some activities, such as adventure sports or extreme outdoor activities, may not be covered by standard health insurance policies. If planning to take part in high-risk activities like hiking, scuba diving, or skiing, it’s worth looking for additional coverage. Lots of insurance providers offer optional add-ons for these types of activities, providing extra protection in case of an accident or injury.

Secure Your Health, Enjoy Your Adventure!

Traveling abroad without adequate health cover can be risky. With the right planning and research, securing the right health insurance is simple. Understanding the basics and checking for coverage of pre-existing conditions are all essential steps in finding the right policy. By following these important tips, overseas health cover can be easy to navigate, leaving more time to enjoy the adventure ahead.

Post Comment

Be the first to post comment!