Managing a business’s finances isn’t just about collecting payments. It’s also about everything that follows, disbursing salaries, paying vendors, handling taxes, and keeping things compliant. In many cases, this means toggling between spreadsheets, banking portals, and third-party software.

RazorpayX attempts to address this by offering a bundled approach to business banking, but what does that include? And how is it different from Razorpay’s usual payment solutions?

Razorpay vs RazorpayX – What’s the Real Difference?

Think of Razorpay as the system that helps you get paid, via credit cards, UPI, netbanking, etc.

Now, picture RazorpayX as the system you use after you’ve been paid. It helps with:

- Sending money to employees, vendors, and partners

- Automating tax filings

- Running payroll

- Managing business banking needs like current accounts and bulk payouts

In short:

Razorpay = Front desk for payments

RazorpayX = Back office for banking

RazorpayX Current Account: The Digital-First Banking Experience

RazorpayX Current Accounts don’t replace your bank, they work with your bank. These accounts are powered by partner banks like ICICI, Yes Bank, and RBL, and they’re designed specifically for businesses.

What’s different about it?

- You don’t have to walk into a branch for anything.

- You can pay vendors in bulk, up to 50,000 payouts at once, with just a single OTP.

- New beneficiaries? No waiting. No cooling period.

- You can assign approval workflows. That means one person can create a payment and someone else can approve it.

- It’s API-ready if your dev team wants to automate finance flows.

In short, it brings banking up to speed with how businesses work today.

RazorpayX App for Daily Financial Operations

The RazorpayX mobile app is designed to give businesses access to their financial processes without being tied to a desktop. It’s not limited to just viewing balances, users can carry out actions like approving payouts, checking account statements, monitoring transactions, and managing user roles.

This kind of functionality is particularly useful for teams that manage finance collaboratively or for business owners who need to stay updated while on the move.

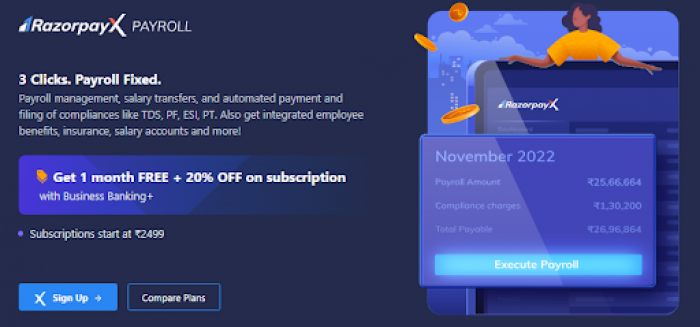

RazorpayX Payroll: Automating Routine Compliance and Payouts

RazorpayX Payroll is a cloud-based system developed to simplify how businesses handle employee payments and compliance tasks. Instead of relying on multiple tools for salaries, tax filing, and documentation, the platform integrates these processes into a single system.

It calculates salaries, applies relevant deductions, and handles statutory filings for TDS, PF, ESIC, and professional tax across all states and union territories. Payslips are auto-generated, and salaries are credited directly to employee accounts. Employees can also access their own payroll information via a self-service portal.

For businesses dealing with recurring payroll cycles, this setup helps reduce manual errors and time spent on repetitive tasks.

Razorpay & RazorpayX Pricing: A Clear Breakdown

Understanding the cost of using Razorpay’s services is crucial before integrating it into your business operations. Below is a simplified overview of the pricing across Razorpay’s major offerings: Payments, Banking+, Payroll, and Credit Solutions.

1. Payment Gateway Pricing

- Platform Fee: 2% per transaction for domestic payments.

- GST: 18% extra on the platform fee.

- Setup Fee: None.

- Annual Maintenance: None.

- Enterprise Pricing: Custom rates available for businesses processing over ₹5 lakh per month.

2. RazorpayX Business Banking Pricing

- Includes access to a current account (powered by partner banks), vendor payouts, tax payments, and approval workflows.

- Charges may vary based on transfer method (IMPS, UPI, NEFT, RTGS) and transaction volume.

- No setup fee publicly disclosed.

- APIs and app access are included for automation and mobile control.

3. RazorpayX Payroll Pricing

- Free Plan: Up to 10 employees.

- Standard Plan: Starts at ₹2,499/month for automated salary processing, compliance filings (TDS, PF, ESIC, PT), and employee self-service.

- Enterprise Plan: Custom pricing available for large teams or businesses needing additional integrations.

4. Credit Line Pricing

- Interest: Starts at 1.5% per month.

- Limit: Up to ₹25 lakhs.

- No collateral required and no pre-closure fee.

- 24/7 withdrawal access with flexible repayment options.

Key Notes

- Pricing across all services is subject to 18% GST.

- No hidden setup or maintenance charges for most standard plans.

- Custom pricing is available based on business size and usage volume.

This structured pricing model allows businesses to start small or scale with custom features depending on their operational needs.

RazorpayX Payroll Login: Where to Begin

Logging in is simple:

- Go to payroll.razorpay.com

- Use your registered credentials

- Access payroll dashboards, tax filing reports, employee data, and salary history

No need to download anything. Everything runs in the cloud, and updates happen automatically.

RazorpayX Business Banking: More Than Just a Name

You’ve got:

- A Current Account with fast payouts and no red tape

- A Payroll engine that handles everything from onboarding to taxes

- A Dashboard and app that work together

- Support for Escrow, Vendor payments, and Forex transfers

All of this isn’t just modular add-ons—it’s a system designed to work together. And that’s rare in India’s fragmented fintech landscape.

Is RazorpayX Worth Exploring?

This isn’t about whether you should “go for it.” That’s your call. What matters is: if you’re still relying on disconnected tools to manage employee salaries, file taxes, and pay vendors, there’s a better way to organize it.

RazorpayX isn’t perfect. But it gets a lot of the annoying, repetitive finance stuff off your plate. And it’s built with Indian businesses in mind.

Post Comment

Be the first to post comment!