On This Page

- Strategic Reboot in Silicon Trade Policy

- Why the H20 Matters: A Compromise Between Innovation and Control

- Rare Earth Element Link: The Real Driver Behind the Reversal

- Political Backlash and National Security Debate

- Nvidia’s Economic Stakes: China Still a $17B Market

- What Chinese Firms Are Getting: H20 and RTX Pro

- What About Other Chipmakers?

- FAQs

- Conclusion: A Tactical Pause, Not a Policy Shift

Strategic Reboot in Silicon Trade Policy

In a significant policy shift, Nvidia has resumed sales of its H20 AI chips to Chinese firms after a months-long export restriction. The move follows high-level negotiations between the U.S. and China over rare earth element exports, signaling a delicate trade-off between economic interest and geopolitical caution.

According to a TechCrunch report, the Biden administration approved a limited resumption of H20 shipments as part of a broader arrangement tied to critical mineral access from China. The H20 chip is Nvidia’s fourth-tier offering, designed to meet U.S. export rules without enabling China to access its most advanced AI computing capabilities.

Why the H20 Matters: A Compromise Between Innovation and Control

The H20 GPU is a custom model created to comply with U.S. export restrictions under the October 2023 guidelines. It sits below Nvidia’s A100, H100, and H200 chips in compute performance and bandwidth, making it less suitable for training frontier AI models like GPT-5. However, it is still powerful enough to support many generative AI use cases in the Chinese market.

Reuters reports that Nvidia will now ship the H20 to select Chinese customers under renewed export licenses. The company has confirmed that the chip does not violate any ongoing Commerce Department restrictions. Nvidia CEO Jensen Huang stated during the Beijing Supply Chain Expo that “China will only get our fourth-best GPU,” indicating the U.S. is not ceding access to its latest AI advancements.

Rare Earth Element Link: The Real Driver Behind the Reversal

According to Fortune India, the U.S. softened Nvidia’s export stance after Beijing hinted at lifting its restrictions on rare earth magnets—materials vital to clean energy, electronics, and defense sectors. China controls around 87% of global rare earth refining, giving it strategic leverage in trade negotiations.

Unnamed officials familiar with the discussions told TechCrunch that the Nvidia greenlight was “not a concession but a calculated trade mechanism” intended to ensure U.S. access to rare earths while maintaining limits on China’s AI development capabilities.

Political Backlash and National Security Debate

While Nvidia and the Biden administration describe the move as strategic, several U.S. lawmakers have voiced concerns. TechCrunch cited Republican lawmakers who criticized the policy as “inconsistent” with broader efforts to curb Chinese access to sensitive technology.

Still, David Sacks, the White House’s AI adviser, defended the decision to Business Insider. He explained that the goal is not to cut China off entirely, but to prevent advanced players like Huawei from monopolizing the local AI supply chain. “This is about capping capability, not eliminating it,” Sacks said.

Nvidia’s Economic Stakes: China Still a $17B Market

Nvidia has strong incentives to re-engage with Chinese buyers. According to Reuters, China accounted for about 13% of Nvidia’s $66 billion revenue in FY2024—roughly $8.6 billion. The company warned earlier this year that the loss of Chinese sales could cost up to $5.5 billion annually.

Nvidia is the world’s most valuable company, and last week became the first publicly traded firm to reach a valuation of $4 trillion

Following the policy change, Nvidia shares rose over 4% as investors welcomed the partial restoration of a crucial revenue stream. Analysts believe that while H20 chips won’t drive the same margins as H100s, they offer much-needed volume in a competitive global AI market.

What Chinese Firms Are Getting: H20 and RTX Pro

At the Beijing Expo, Huang unveiled the new RTX Pro chip—designed specifically for Chinese industrial AI applications such as robotics, manufacturing automation, and video analytics. This launch is seen as a separate but complementary effort to provide China with compliant computing power without crossing U.S. red lines.

He also praised several Chinese foundation model developers—including DeepSeek, Alibaba, Tencent, and ByteDance—calling their AI models “world-class,” even under constrained hardware conditions.

What About Other Chipmakers?

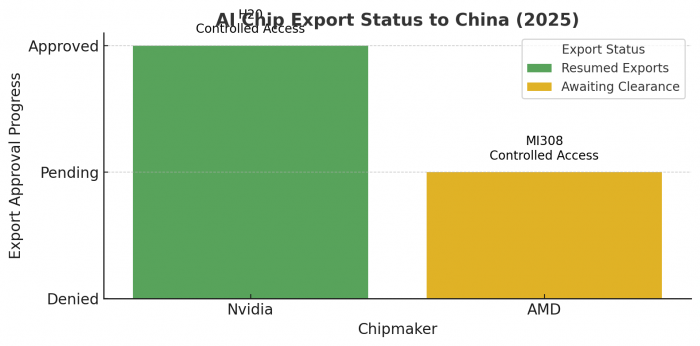

Nvidia isn’t alone. AMD is reportedly seeking Commerce Department approval to resume exports of its MI308 chips to Chinese partners. However, unlike Nvidia, AMD has not yet received formal clearance.

The Wall Street Journal notes that U.S. authorities are considering case-by-case licensing for legacy and downgraded chips as part of a “controlled access” policy, similar to the strategy applied to Nvidia.

FAQs

Is Nvidia still banned from selling AI chips to China in 2025?

Only partially. While the U.S. ban on advanced chips like the H100 remains, Nvidia’s H20 GPU—built to comply with U.S. rules—is now cleared for sale to China under specific conditions.

Why did the U.S. allow Nvidia to resume H20 sales?

According to TechCrunch and Fortune India, the decision is tied to broader negotiations with China over rare earth element exports, which are essential for U.S. technology and defense industries.

What is the H20 GPU used for?

The H20 is optimized for AI workloads that do not require frontier-level compute, such as enterprise generative AI, image recognition, and mid-tier LLM inference tasks.

Which companies in China are buying Nvidia’s H20 chips?

While Nvidia hasn’t disclosed buyers, analysts expect major cloud providers like Alibaba Cloud and Tencent Cloud to be among the first customers.

Conclusion: A Tactical Pause, Not a Policy Shift

Nvidia’s return to the Chinese market with H20 chips is a tactical maneuver driven by trade leverage and geopolitical necessity. It neither represents a full policy reversal nor a long-term greenlight for AI tech exports. Instead, it underscores the increasingly transactional nature of global tech policy—where innovation, commerce, and national security are constantly being recalibrated.

As U.S.–China tensions continue to play out in silicon and supply chains, all eyes will be on how this narrow exception impacts both Nvidia’s strategy and the future of controlled AI growth worldwide.

Post Comment

Be the first to post comment!