On This Page

- The Internet’s New Highway Is Under the Ocean

- Meta's Project Waterworth: The Longest Cable on Earth

- Google’s Humboldt Cable: Linking Chile to Australia

- Why Subsea Cables Matter

- Ownership Shift: From Telecom Consortia to Tech Giants

- Regulatory Spotlight: Cables and National Security

- At a Glance: Meta vs Google Subsea Strategy

- Final Thoughts: The Subsea Race Is On

The Internet’s New Highway Is Under the Ocean

In a bold move to redefine global internet infrastructure, Meta and Google are investing billions into next-generation subsea cable networks. These undersea megaprojects are expected to deliver unparalleled bandwidth, reduce global latency, and serve as the digital backbone for emerging AI-powered applications.

According to CNBC, these tech giants are laying thousands of kilometers of cable to strengthen internet resilience across the Americas, Africa, Asia, and Oceania—at a scale and speed never seen before.

Meta's Project Waterworth: The Longest Cable on Earth

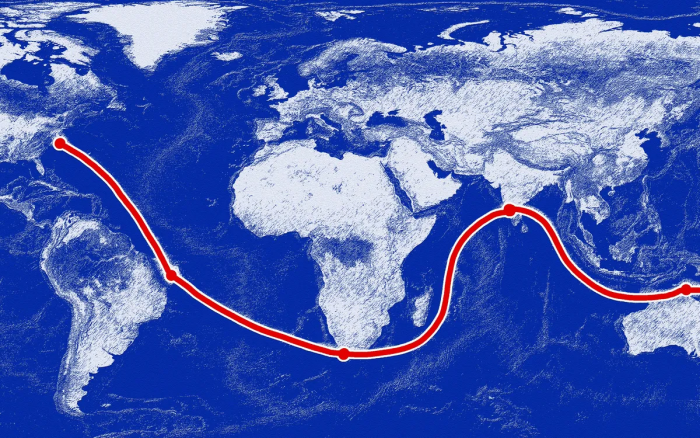

Meta’s ambitious Project Waterworth is slated to become the world’s longest subsea cable system, stretching over 50,000 kilometers—longer than Earth’s circumference. It will connect the U.S., South America, Africa, and India with a 24-fiber-pair architecture, far exceeding the typical 8- or 16-pair systems used in commercial deployments.

As confirmed by Meta’s engineering blog, the project is tailored to handle surging AI workloads, particularly those flowing between global data centers and emerging user markets like India and Brazil.

Waterworth also emphasizes route diversity. Instead of passing through geopolitically tense chokepoints like the Red Sea or South China Sea, it takes alternate deep-water paths down to 7,000 meters, minimizing risks of sabotage or surveillance.

Google’s Humboldt Cable: Linking Chile to Australia

In parallel, Google is accelerating deployment of the Humboldt Cable, a trans-Pacific subsea cable connecting Valparaíso, Chile to Sydney, Australia. According to AP News, the initiative includes $25 million in Chilean government support and is expected to complete by 2027.

The Humboldt Cable strengthens Latin America’s digital independence and boosts Google's broader cloud ecosystem across Oceania and Southeast Asia. It adds another route to Google’s massive portfolio, which already includes Grace Hopper (U.S.–U.K.–Spain), Nuvem (U.S.–Portugal–Bermuda), and Equiano (Portugal–Africa).

Why Subsea Cables Matter

Over 95% of global internet traffic flows through undersea cables—not satellites. These cables are the foundation of everything from video streaming to financial transactions to AI inference jobs.

Meta’s and Google’s investment reflects:

- Rising AI compute needs, where low latency between global data centers becomes essential.

- Increasing concerns over internet sovereignty and avoiding politically sensitive regions.

- The need for resilient, high-capacity links in an age of data localization and geopolitical fragmentation.

As noted in IEEE Spectrum, hyperscalers are now treating subsea cables as a core part of AI infrastructure—not just communication assets.

Ownership Shift: From Telecom Consortia to Tech Giants

Traditionally, subsea cables were owned by consortia of telecom carriers. That’s changing.

Meta’s Waterworth is its first wholly-owned global cable, diverging from prior consortium efforts like 2Africa. Meanwhile, Google has been the world’s most aggressive private investor in subsea infrastructure since 2016, spending over $47 billion on network expansions, according to TechXplore.

This shift allows hyperscalers to control latency, security, and costs—while supporting the delivery of AI, cloud, and VR/AR services at global scale.

Regulatory Spotlight: Cables and National Security

Not everyone welcomes this private cable boom. As reported by the Financial Times, U.S. regulators are pushing for bans on Chinese-made cable equipment, citing potential cybersecurity threats.

The BBC also highlighted growing geopolitical concerns that undersea infrastructure may become a proxy battlefield between tech and nation-states, with rising sabotage threats, surveillance attempts, and data sovereignty disputes.

At a Glance: Meta vs Google Subsea Strategy

| Feature | Meta (Waterworth) | Google (Humboldt + Portfolio) |

| Cable Length | 50,000 km+ (record-breaking) | ~15,000 km (Chile to Australia) |

| Route | U.S. ↔ Brazil ↔ Africa ↔ India | Chile ↔ Australia (trans-Pacific) |

| Fiber Architecture | 24 fiber pairs | Not disclosed |

| Deployment Year | Late 2020s | 2027 (Humboldt) |

| Business Model | Fully owned | Co-owned and leased |

| Strategic Goal | AI infrastructure + route resilience | Cloud expansion + South Pacific redundancy |

| Risk Management | Avoids chokepoints (Red Sea, South China Sea) | Strengthens digital links outside U.S.-China axis |

Final Thoughts: The Subsea Race Is On

From The Verge’s deep dive to CNBC’s coverage of the growing cable “web” (CNBC), one thing is clear: the next decade of digital transformation will run on fiber, not just silicon.

By investing billions in undersea cables, Meta and Google aren’t just improving internet speed. They’re securing sovereignty over bandwidth, reducing global AI latency, and rewriting the rules for international digital infrastructure.

Post Comment

Be the first to post comment!