On This Page

- Why Financial Efficiency Matters Now

- Automating Accounting: A Strategic First Step

- The Power of Cloud-Based Financial Platforms

- Transparency: The Cornerstone of Smarter Decisions

- Managing Cash Flow: Tools That Help

- What High-Growth Enterprises Are Doing Differently

- What You Can Do Today

- Final Thoughts

In today’s enterprise economy, profit margins hinge not just on sales but on how intelligently organizations manage their finances. Financial efficiency—the ability to generate maximum output with minimum financial input—is more than a metric. It’s a survival skill.

This post breaks down specific ways businesses can maximize their financial efficiency with actionable insights, relevant tools, and strategic practices. From automating accounting to fostering data transparency, let’s explore the tactics modern businesses are embracing to do more with less.

Why Financial Efficiency Matters Now

Let’s start with the obvious: costs are rising. Labor productivity growth is stalling, with projections showing only a 1% employment growth rate in 2023 according to the ILO. At the same time, wages aren’t keeping pace—in Q1 2023, real wages dropped 3.8% in most OECD countries.

Yet, despite these conditions, competition remains fierce. Businesses must find smarter ways to manage money. Not just cut costs—but optimize operations. And that starts with technology.

Automating Accounting: A Strategic First Step

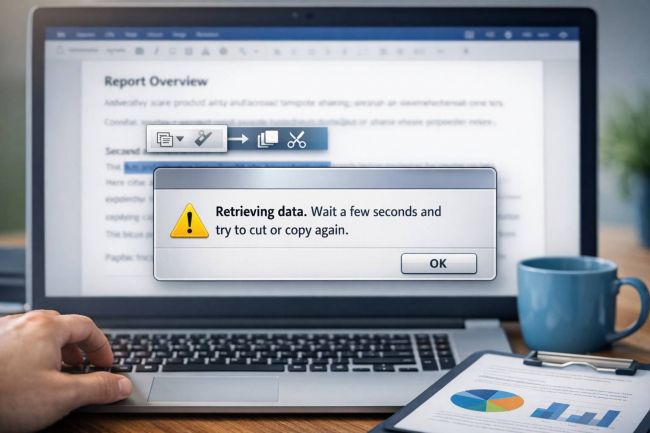

Many businesses still rely on manual spreadsheets and outdated software for bookkeeping. That’s risky, slow, and inefficient. Accounting automation doesn’t just reduce errors—it saves hours of human time each week.

Tools like Xero, QuickBooks, and Zoho Books offer AI-assisted data entry, bank feed integrations, and automatic reconciliation. But adopting these tools strategically is key.

Here’s where improving accounting efficiency matters most:

- Invoice processing: Automatically match payments with invoices.

- Expense tracking: Real-time visibility into spending.

- Payroll management: Reduce manual calculations and tax filing errors.

When implemented correctly, businesses free up resources to focus on higher-value financial planning.

The Power of Cloud-Based Financial Platforms

On-premise software is becoming a liability. Cloud-based platforms are not only scalable and cost-effective—they also provide access to real-time data anytime, anywhere.

Platforms like FreshBooks and Oracle NetSuite offer:

- Centralized dashboards

- Automated workflows

- Real-time reporting

More importantly, they eliminate data silos between departments. That’s a game-changer when it comes to decision-making. If your marketing team knows how much was spent yesterday, and your CFO can forecast next month’s spend in seconds—you’re operating on a different level.

According to the SHRM 2023–2024 report, 87% of employees want better compensation transparency. Cloud-based tools help lay the groundwork by connecting pay data to performance and productivity.

Transparency: The Cornerstone of Smarter Decisions

What gets measured, gets managed. But what’s visible gets improved.

Transparency in financial data isn’t just about honesty—it’s about clarity. When stakeholders—from boardrooms to department leads—understand the current financial picture, they make better decisions.

A few tangible benefits:

- Better budgeting across teams

- Faster responses to cash flow issues

- Greater employee trust in leadership

And transparency isn’t limited to financial reporting. It extends to labor data, pricing models, and even supplier costs. The more visible your data, the easier it is to optimize operations.

Managing Cash Flow: Tools That Help

Cash flow is the lifeblood of a business. Yet many enterprises still manage it reactively.

Understanding how to manage cashflow proactively—through forecasting, budgeting, and contingency planning—can mean the difference between growth and crisis.

Popular tools include:

- Float: Integrates with Xero and QuickBooks to forecast cash.

- Pulse: Focused on startups and service-based businesses.

- PlanGuru: Ideal for multi-department forecasting.

Action step: Build a rolling 13-week forecast. Review it weekly. Adjust for expected receivables, seasonal dips, and one-off expenses.

What High-Growth Enterprises Are Doing Differently

Successful enterprises don’t necessarily spend more—they spend smarter.

| Tactic | Common Enterprises | High-Growth Enterprises |

| Bookkeeping | Monthly manual entry | Automated, real-time tracking |

| Expense management | Reactive | Proactive categorization |

| Financial planning | Annual budgeting | Dynamic, rolling forecasts |

| Tech adoption | Selective | Integrated, cloud-first |

These organizations view financial tools not as overhead, but as multipliers. They prioritize cross-functional visibility and invest in staff training to get the most from their platforms.

What You Can Do Today

Want to start maximizing your financial efficiency? Start small. Here are a few practical steps:

- Audit your financial processes: Where are the bottlenecks?

- Invest in one automation tool: Don’t try to change everything overnight.

- Create a simple dashboard: Track cash flow, expenses, and income daily.

- Train your team: Tools don’t drive efficiency—people using them well do.

Also, consider benchmarking your performance quarterly. Use KPIs like net profit margin, current ratio, and days sales outstanding (DSO) to measure progress.

Final Thoughts

Financial efficiency isn’t about spending less—it’s about spending wisely. By adopting automation, embracing cloud-based platforms, and prioritizing transparency, businesses can build resilience and agility. In a time of labor shortages, legal reforms, and shifting compensation expectations, strategic financial management isn’t optional—it’s foundational.

To take it further, adopting visual workflows can significantly streamline your processes and reduce decision lag. If you're unfamiliar with how visual workflows enhance clarity and execution across teams, this guide on what a visual workflow is and how it improves business efficiency breaks it down with practical insights. It’s an ideal next step for teams aiming to convert financial strategy into daily action.

The tools are out there. The tactics are proven. Now’s the time to act.

Post Comment

Be the first to post comment!