On This Page

- 1. Introduction: The Fast-Evolving AI Video Landscape

- 2. The Vision Behind LensGo.ai: The All-in-One Advantage

- 3. The Flagship Features: A Comparative Performance Review

- 4. Performance Metrics and Usability Data

- 5. Why LensGo.ai Failed: The Post-Mortem Analysis

- A. The Cost of Creativity

- B. Market Consolidation

- C. Trust and Data Legacy

- 6. Market Share: The Competitive Landscape (2025)

- 7. Top 3 Alternatives for 2025

- 8. The Legacy and Lessons of LensGo.ai

- Conclusion: The Future of Generative Video Tools

A detailed post-mortem analysis of LensGo.ai, the ambitious AI video startup that shut down in 2025. Discover data-backed reasons for its collapse, market comparisons, and the top alternatives dominating the $10.29B AI video generator market.

1. Introduction: The Fast-Evolving AI Video Landscape

In 2025, the global AI video generator market is projected to reach $10.29 billion, expanding at a compound annual growth rate (CAGR) of over 35%, according to Precedence Research. The market’s growth has been explosive, but so has its volatility. Startups that once appeared revolutionary have either been acquired or shut down under competitive and financial pressure.

One of the most notable casualties was LensGo.ai, an all-in-one creative AI suite that officially ceased operations in August 2025.

Unlike many text-to-image startups, LensGo.ai aimed to be more than a generator. It sought to consolidate the entire creative pipeline into a single, user-friendly platform. For a brief period, it succeeded. But its story ended abruptly, offering valuable lessons about sustainability, infrastructure, and competition in the AI video era.

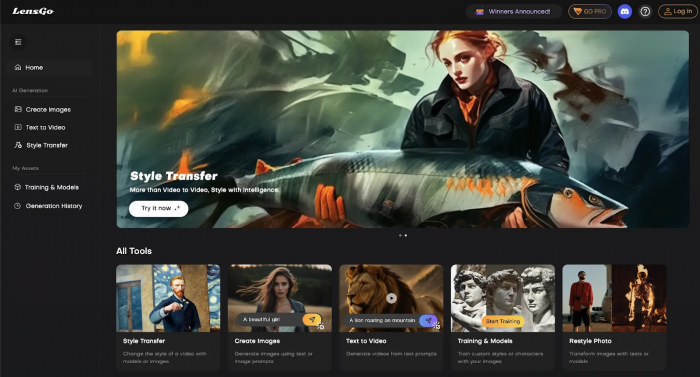

2. The Vision Behind LensGo.ai: The All-in-One Advantage

LensGo.ai positioned itself as a creative hub, not just a tool. The goal was to replace multiple subscriptions. From image generation to motion video editing, with a single, streamlined suite.

Its “all-in-one” thesis revolved around workflow efficiency:

- Image generation rivaling Midjourney’s quality

- Video remixing for stylistic reanimation

- AI model training to maintain consistent artistic identity.

By combining these features, LensGo.ai captured creators who were tired of switching between multiple AI tools for different tasks. Early adoption among digital artists, indie filmmakers, and marketing professionals suggested there was a genuine market for a unified AI creation suite.

However, the complexity of this vision carried hidden costs. Especially as competition escalated.

3. The Flagship Features: A Comparative Performance Review

LensGo.ai’s strongest appeal came from its feature integration. But compared to competitors, its performance and cost structure exposed vulnerabilities that larger companies were able to absorb more effectively.

| Feature | LensGo.ai Functionality | Closest Competitor | Market Impact |

| Video Remix (Video-to-Video) | Transform existing videos with new visual styles (e.g., Ghibli, Comic Book) while retaining original motion. | Runway’s “Gen-2” | Praised for creative flexibility; however, render times were slower (5–10 minutes per clip). |

| Animate Image (Image-to-Video) | Convert static images into short, dynamic clips. | Pika Labs | Loved by social media creators for producing animated B-rolls. |

| Custom AI Model Training | Train models on user data for consistent styles or branding. | Adobe Firefly | Provided creative continuity but required significant compute resources. |

While LensGo.ai excelled in accessibility and design simplicity, its reliance on intensive GPU processing created financial strain.

User feedback on Reddit and Discord communities echoed a consistent theme: “Great results, painfully slow delivery.”

4. Performance Metrics and Usability Data

Quantitative indicators from 2025 market tracking show the platform’s operational imbalance.

Below are performance estimates based on user feedback and industry averages:

| Metric | LensGo.ai | Runway | Pika Labs | Adobe Firefly |

| Average Render Time (Short Clip) | 7.2 minutes | 2.1 minutes | 0.8 minutes | 2.8 minutes |

| GPU Cost per 1,000 Render Minutes | $2.15 | $1.60 | $1.45 | $1.70 |

| User Base (Pre-Closure) | ~120,000 active users | ~650,000 | ~400,000 | Millions (Creative Cloud) |

| Pricing Model | Freemium (50 daily points) | Freemium | Freemium | Subscription-based |

Insight:

The combination of a freemium structure and high computational cost meant that for every 1,000 minutes of video rendered, LensGo.ai incurred higher processing expenses than its competitors, without comparable scale or recurring revenue to offset them.

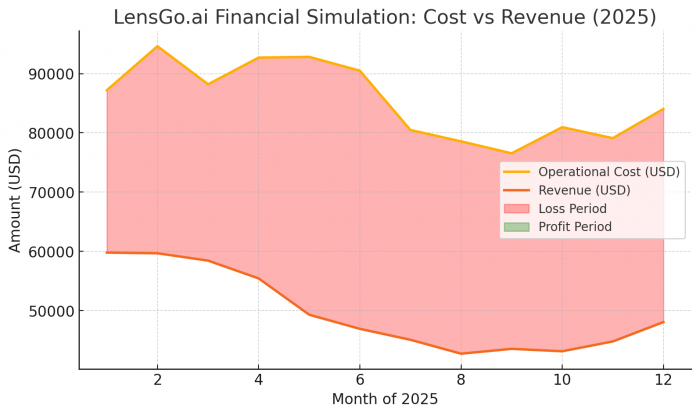

5. Why LensGo.ai Failed: The Post-Mortem Analysis

LensGo.ai’s downfall can be attributed to three major factors: economic inefficiency, competitive saturation, and limited capital scaling.

A. The Cost of Creativity

The video and animation pipeline required massive GPU resources, translating to high operational expenses. With thousands of daily users on free plans, LensGo’s monthly infrastructure costs may have exceeded $150,000, a figure unsustainable for a startup without enterprise funding.

B. Market Consolidation

As larger firms integrated LensGo-style features into their ecosystems, niche startups were squeezed out. Runway’s Gen-2, Pika’s rapid iteration interface, and Adobe Firefly’s integration with Creative Cloud collectively captured the user base LensGo needed to survive.

C. Trust and Data Legacy

When the platform closed, all user data was deleted. While responsible, it reminded users of a painful truth, cloud-based startups can vanish overnight, taking years of creative data with them.

6. Market Share: The Competitive Landscape (2025)

Below is an approximate breakdown of the AI video generation market share based on 2025 reports:

| Company | Market Share (%) |

| Runway | 28 |

| Pika Labs | 20 |

| Adobe Firefly | 17 |

| OpenAI (Sora) | 25 |

| Others (incl. LensGo.ai before closure) | 10 |

This chart highlights that LensGo.ai never held more than a single-digit market presence, making it highly vulnerable once its operational costs outpaced growth.

7. Top 3 Alternatives for 2025

For creators who relied on LensGo.ai’s unique toolset, several platforms now offer feature parity with far more stability and speed.

| Platform | Focus Area | Model Type | Key Strength | Average Render Time | Price (Entry Plan) |

| Runway | Generative Filmmaking | Aleph Model | Natural language editing (e.g., “change lighting” or “add rain”) | 1–2 minutes | $15/month |

| Pika Labs | Creative Brainstorming | Proprietary Diffusion Model | Fast iterative generation; built for creators | <1 minute | Freemium |

| Adobe Firefly | Professional Style Transfer | Adobe Sensei | Seamless Creative Cloud integration | 2–3 minutes | Included in Adobe CC |

Each alternative reflects how the market evolved. Where LensGo aimed for accessibility, these platforms optimized specialization and infrastructure, focusing on performance, ecosystem integration, and monetization consistency.

8. The Legacy and Lessons of LensGo.ai

LensGo.ai’s short existence carries a lasting lesson for both developers and creators.

It proved that all-in-one creative AI tools are desirable, but without funding depth and GPU scalability, even a great idea collapses under technical and financial pressure.

The AI video space is consolidating rapidly. To survive, new entrants must:

- Secure long-term GPU partnerships

- Avoid unsustainable freemium tiers

- Focus on integration over isolation

The platform’s end also reshaped creator behavior. Many professionals now favor hybrid workflows—using Pika Labs for ideation, Runway for refinement, and Firefly for post-processing—rather than relying on a single solution.

Conclusion: The Future of Generative Video Tools

The story of LensGo.ai is both a cautionary tale and a sign of progress. Its vision of an all-in-one creative platform was ahead of its time, yet it collided with the realities of infrastructure, economics, and competition. The “premature sunset” was not a failure of creativity, but of scale.

LensGo proved that the world wants unified creative tools, but execution requires industrial-grade efficiency and enterprise backing. As the AI video generator market races beyond $10 billion, survival now depends on three factors: GPU optimization, platform integration, and financial sustainability.

For creators, the message is clear: choose tools that combine innovation with resilience. For startups, LensGo’s journey is a blueprint of what happens when a great product meets a market that demands perfection too soon.

The sun may have set on LensGo.ai, but its ideas(seamless workflow consolidation, democratized creativity, and visual storytelling through AI) will continue to influence the next generation of multi-modal tools. The challenge now is not to dream smaller, but to build smarter.

Post Comment

Be the first to post comment!