On This Page

- Importance of innovation in financial institutions

- What technologies to look out for?

- What areas should finance companies improve?

- Challenges of new technology

- Benefits of adopting the latest technology

- How to create an innovation-driven workforce

- The role of leadership in driving innovation

- Innovation is crucial for financial institutions

One of the fields that has been significantly evolving in the past decades is finance. With the rise of the internet, blockchain, and eventually, AI, financial institutions have changed the way in which they conduct business.

As a finance business, you should aim to research the latest technologies and find the best innovations to implement in your business. This doesn’t mean that you should be an early adopter of a new trend for the sake of it, but rather to seek out what innovations can give you a competitive edge.

This article delves deep into the importance of innovation and what technologies you should look into in the current year. Eventually, it’s up to you what innovations are worth it, but it’s more important that you develop a mindset for embracing new trends.

Importance of innovation in financial institutions

Finance is a field that has more regulation than any other. This is because financial institutions have existed for hundreds of years; thus, their laws and regulations are polished. Furthermore, criminal activity is made possible if a financial company has a vulnerability in its operations.

Embracing the latest technology enables financial institutions to enhance efficiency, improve customer experiences, and maintain regulatory compliance. It’s essential that you leverage reliable and legitimate technology.

Fintech startups shouldn’t allow themselves to use outdated tools and software.

What technologies to look out for?

One of the most important changes to all industries is the rise of artificial intelligence. This technology has significantly expanded our capabilities, and financial institutions shouldn’t miss out on it.

For example, AI can be used to create better content and market your product. It can be used to hire rare top talent who are educated in compliance, cybersecurity, and software development. Furthermore, AI is also used in monitoring tools.

You can read these reviews and the importance of AI for anti-money laundering tools that allow you to avoid problems with suspicious users. The term RegTech (Regulatory Technology) refers to automated compliance tools that streamline reporting, reducing costs and errors in adhering to regulations.

By using automated tools in compliance and cybersecurity, you’ll be able to streamline your processes and focus your manpower and resources where they’re needed.

Another important field for security is authentication protocols. Most importantly, you should implement biometric authentication in order to protect both your users and employees.

While not the latest trends like AI, blockchain, and Distributed Ledger Technology (DLT) also have an important role in the current fintech landscape. This goes beyond cryptocurrencies, as blockchain allows secure, immutable, and transparent transactions.

What areas should finance companies improve?

To stand out among the competition, fintech companies should pay close attention to customer experience. There are many great applications that are too obscure and complex for the average user. Through technology that streamlines design and development, such as frameworks, the end product will be more elegant and easy to use.

To further enhance user experience, you should prioritize user-friendly platforms, mobile banking, and AI-driven customer support.

When it comes to finance, one of the most important aspects of a good product is cybersecurity. Data leakages or lost funds can literally destroy your business, leading to loss of trust, blows to your reputation, and fines.

You should protect your business in real time through software that’s up to the industry standard. Good cybersecurity directly leads to better regulatory compliance and more trust.

Incorporate green finance initiatives, such as ESG (Environmental, Social, and Governance) investments and carbon-neutral practices. This can significantly improve your reputation. Many people criticize Bitcoin because of its environmental impact.

The latest HR platforms offer a number of features that could help you upskill your workforce. In the long run, this will allow you to build a workplace culture and employee loyalty. Don’t neglect modern HR solutions, even if they can be costly.

Challenges of new technology

Implementing the latest innovations isn’t as straightforward as many may think. First of all, there’s always a chance that this technology has some inherent flaws. For example, blockchain revolutionized finance, yet we’ve also seen a number of online scams and rug pulls.

The latest technology can also have high implementation costs as there won’t be a lot of experts who’ll be able to integrate it into your system. Furthermore, there could be costs associated with equipment, software, and maintaining both.

Some innovations can be unregulated. This means that you could potentially break certain laws. Whatever the pros of such technology could be, your business could suffer if the regulatory landscape changes.

There can also be a resistance to change for both employees and customers. For example, your cybersecurity experts could have a negative outlook on AI tools. Similarly, your customers can be hesitant to start using a new feature or a platform.

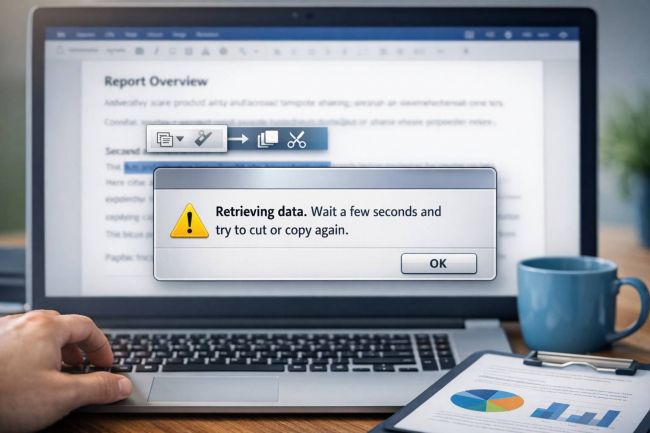

You should keep in mind that some features can be too technically complex for the average customer. This could lead to an outright loss of customers or to costs associated with creating a knowledge base and tutorials.

New integrations can cause disruptions in legacy systems. For example, many financial institutions are using old programming languages such as Cobold, and the latest software can be impossible to integrate with it.

Benefits of adopting the latest technology

Through adopting the latest innovations, you’ll show your customer base that you’re keeping up to date with the market. This will help you build customer loyalty, and the potential for long-term collaborations.

Many of the innovations we’ve mentioned throughout the article have a direct positive impact on the efficiency of your business. For example, AI can help you automate processes and boost your productivity.

On the other hand, innovations in cybersecurity can help you with risk management, allowing you to tackle vulnerabilities adequately. Adopting the latest trends in cybersecurity, for example, can help you avoid emerging cyber threats.

Regardless of the services that you offer, cybersecurity is essential for protecting your fintech business.

As mentioned throughout the article, early adopters of new technology can differentiate themselves in the market. This is especially the case if this technology becomes a standard.

How to create an innovation-driven workforce

It’s important that you encourage a growth mindset among your employees, as this will help you embrace the new technologies as a business without any friction. You should provide access to courses and certifications in fintech, AI, and other emerging technologies.

This will help you build a workforce that can quickly adapt to the latest trends. Furthermore, finance seminars and conferences in order to connect yourself and your employees with the like-minded individuals and to be the first one to hear about the latest innovations.

By fostering an environment where employees feel empowered to experiment, fail, and learn, you’ll be able to keep up with any new innovations in the industry. You should never separate your decision-makers and regular employees.

Break down the barriers between them to encourage cross-functional innovation. This can help you make a better product from start to finish.

The role of leadership in driving innovation

Demonstrate a commitment to innovation through actions, not just words. You can’t expect an innovation-driven workforce if you’re personally conservative when it comes to new technology. Develop an innovation strategy and align organizational goals with innovation initiatives.

Make sure to establish incentives and recognition programs for employees who contribute to innovative solutions. Don’t neglect the idea of providing stocks or percentages to employees who are responsible for large improvements and innovations in your company.

Innovation thrives when employees feel empowered to make decisions and take ownership of their work. Leaders should encourage autonomy by allowing employees to make decisions within their areas of expertise, fostering a sense of ownership and accountability.

Give them the freedom to think like entrepreneurs by allowing them to take on side projects or pilot initiatives that could lead to significant innovations within the organization.

Innovation is crucial for financial institutions

The banks that were late in implementing innovations such as electronic and mobile banking were overtaken by their competitors. We can’t put the internet and crypto in the same basket, but you should always strive to seek new ways that could help you stand out.

As a business that favors innovations, you’ll attract top talents, make a more secure platform, and increase your profits in the long run. However, you should be careful with new trends as some can be unnecessary for your business model, while others are outright not useful.

Post Comment

Be the first to post comment!