The Best Security Awareness Training Platforms to Keep Your Business Safe in 2026

In this guide, we will review the best security awareness tr...

by Will Robinson | 4 hours ago

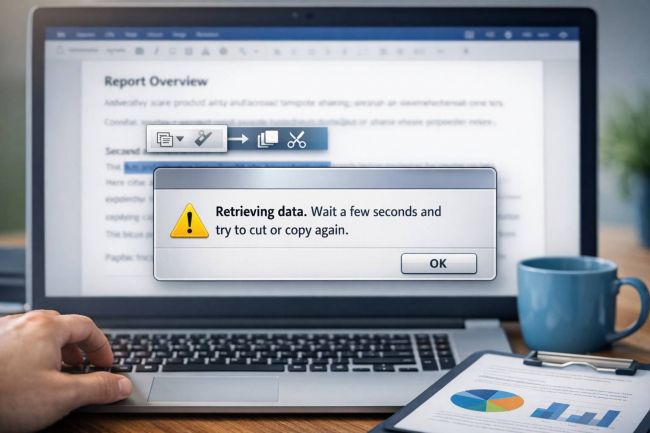

Retrieving Data. Wait a Few Seconds and Try to Cut or Copy Again.

What It Means, Why It Happens, and How to Fix It Permanently...

by Will Robinson | 6 days ago

Israeli Cyber Innovator Torq Hits $1.2 Billion Unicorn Status with $140 Million Series D Funding to Revolutionize AI Security

In a significant development for the global cybersecurity la...

by Will Robinson | 2 weeks ago

Eutelsat Ramps Up Space Race with Order for 340 New Satellites

European satellite operator Eutelsat has placed a major orde...

by Will Robinson | 2 weeks ago

NVIDIA and Global Auto Giants Ignite Next-Gen Self-Driving Era with Reasoning-Based AI Partnerships

The landscape of autonomous transportation is undergoing a m...

by Will Robinson | 2 weeks ago

Amazon Challenges Retail Giants with Massive New Big-Box Store in Chicago Suburb

Amazon is signaling a bold new chapter in its physical retai...

by Will Robinson | 2 weeks ago