On This Page

- How CRM Software Is Used in Practice

- What Separates the Best Software Tools for Managing Customer Relationships

- 1. Salesforce and the Enterprise CRM Model

- 2. HubSpot CRM and the Unified Growth Approach

- 3. Zoho CRM and the Value Oriented Ecosystem

- 4. Freshsales and Simplicity in Sales Execution

- 5. Pipedrive and Pipeline Visibility

- 6. Microsoft Dynamics 365 and Integrated Business Systems

- Pricing, Adoption, and Realistic Expectations

- Closing Perspective

Customer relationships are no longer managed through scattered spreadsheets, inboxes, or personal notes. In 2026, most organizations rely on dedicated software to store customer data, track interactions, and guide decisions across sales, marketing, and support. These systems, commonly known as CRM software, have become foundational business infrastructure rather than optional tools.

The Best Software Tools for Managing Customer Relationships are defined less by flashy features and more by how reliably they organize information, support daily workflows, and adapt as teams grow. This article examines how leading CRM platforms are used today, what differentiates them, and what businesses should realistically expect from each.

How CRM Software Is Used in Practice

At its core, CRM software serves as a shared system of record. It centralizes contact details, communication history, deals, support tickets, and activity logs. In practical terms, this means sales teams know who spoke to a customer last, marketing teams understand campaign engagement, and support teams see the full context of an issue.

By 2026, more than 91 percent of mid-sized companies use CRM systems to automate parts of sales processes and gain customer insights. Cloud based CRM platforms now account for roughly three quarters of deployments, reflecting the shift toward remote work and mobile access.

What has changed most in recent years is the role of AI. CRM tools increasingly assist with prioritization, forecasting, and pattern detection, though they still depend heavily on clean data and human oversight.

What Separates the Best Software Tools for Managing Customer Relationships

While hundreds of CRM tools exist, a small group consistently ranks highest across review platforms due to adoption, usability, and long term scalability.

These tools tend to share several characteristics. They integrate with email and calendars by default. They offer automation for repetitive tasks like follow ups and status updates. They provide reporting that can be understood without advanced analytics training. Most importantly, they are flexible enough to support both small teams and larger organizations, even if at different price points.

1. Salesforce and the Enterprise CRM Model

Salesforce represents the most expansive approach to customer relationship management. It is widely used by large organizations that require deep customization, complex workflows, and extensive third party integrations.

The platform’s strength lies in its scalability and ecosystem. With thousands of extensions available and AI features such as predictive lead scoring and sales forecasting, Salesforce can be shaped to match highly specific business processes.

However, this flexibility comes with trade offs. Implementation often requires specialist support, onboarding can take months, and costs increase quickly as features and users are added. For smaller teams, Salesforce can feel excessive unless long term growth and complexity justify the investment.

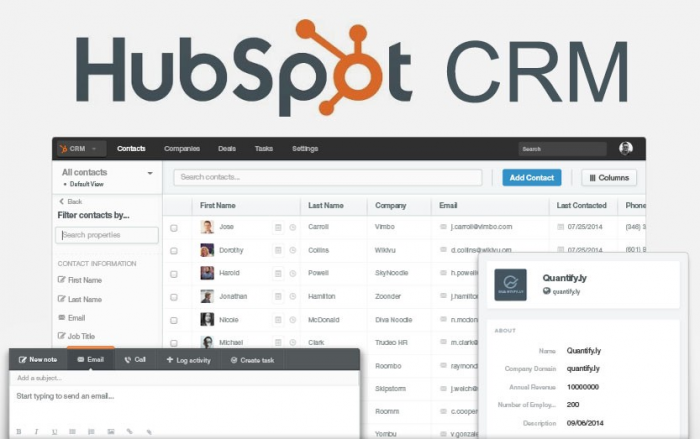

2. HubSpot CRM and the Unified Growth Approach

HubSpot takes a different path by emphasizing usability and alignment between sales and marketing. Its CRM is widely adopted by small and mid sized businesses, in part because the core platform is available at no cost.

In practice, HubSpot works well for teams that rely on inbound leads, content marketing, and email engagement. Contact tracking, deal pipelines, and basic automation are accessible without configuration overhead.

As organizations scale, limitations appear around advanced customization and automation depth. Costs also rise as contact volumes increase. Still, HubSpot remains a common entry point for businesses formalizing customer management for the first time.

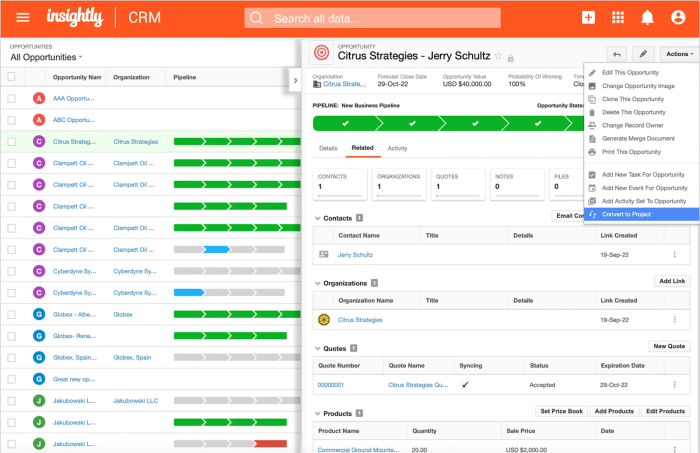

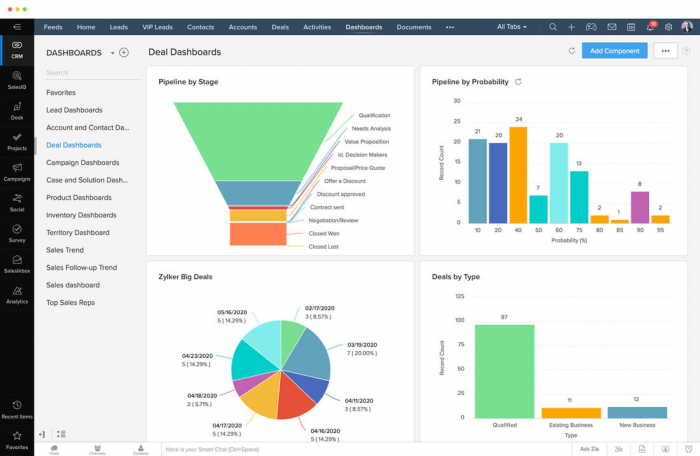

3. Zoho CRM and the Value Oriented Ecosystem

Zoho CRM appeals to organizations seeking balance between affordability and functionality. It offers AI assisted insights through its Zia engine, along with workflow automation and multi channel communication.

One defining feature of Zoho CRM is its integration with the broader Zoho suite, which includes accounting, helpdesk, and project management tools. For businesses already using these products, the CRM fits naturally into daily operations.

User feedback often highlights strong feature coverage for the price, alongside occasional concerns about interface polish and enterprise level support. Zoho is commonly chosen by growing teams that want control without premium pricing.

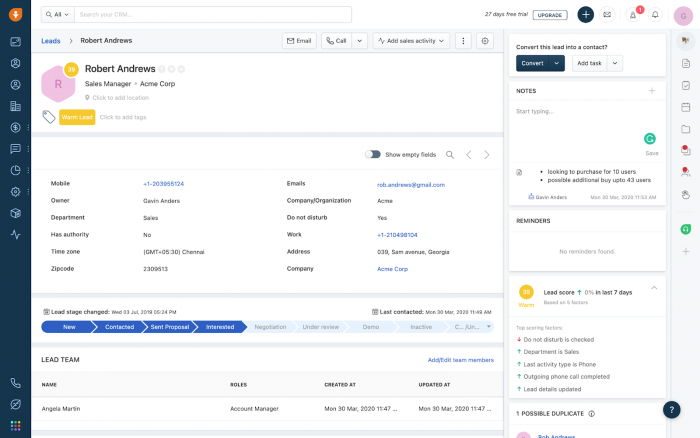

4. Freshsales and Simplicity in Sales Execution

Freshsales focuses on making sales management straightforward. It combines contact management, visual pipelines, and communication tools such as built in phone and email tracking.

Its AI features assist with lead scoring and deal insights rather than broad predictive analytics. This narrower focus makes Freshsales easier to adopt, especially for sales teams that want clarity rather than customization.

While Freshsales handles core CRM needs well, more advanced features are sometimes gated behind add ons. It is often selected by teams prioritizing ease of use over depth.

5. Pipedrive and Pipeline Visibility

Pipedrive is designed around the idea that sales progress should be visible at a glance. Its interface centers on pipelines, allowing teams to move deals through stages with minimal friction.

This approach works well for sales driven organizations that rely on structured processes and frequent deal updates. Automation handles routine tasks like follow ups and reminders, reducing manual tracking.

Marketing and analytics features are more limited compared to broader CRM platforms. As a result, Pipedrive is typically used alongside other tools rather than as a single system for all customer interactions.

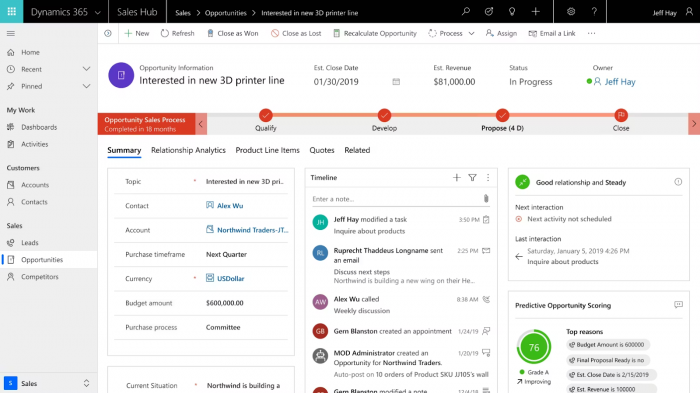

6. Microsoft Dynamics 365 and Integrated Business Systems

Microsoft Dynamics 365 targets organizations already embedded in the Microsoft ecosystem. It connects CRM functionality with tools like Outlook, Teams, and Excel, creating a familiar environment for users.

AI driven insights through Copilot support forecasting and customer analysis, particularly in enterprise settings. Dynamics is often used in conjunction with ERP systems, making it suitable for complex operations.

The platform’s breadth can introduce complexity for teams unfamiliar with Microsoft’s enterprise stack. Pricing also reflects its positioning toward larger organizations.

Pricing, Adoption, and Realistic Expectations

Across CRM platforms, pricing varies widely. Free tiers support startups and small teams, while enterprise deployments can exceed $100 per user per month. On average, organizations spend about $26 per employee on CRM software.

Hidden costs often include contact limits, advanced automation, and reporting add ons. Adoption rates typically range from 59 to 72 percent, with onboarding cited as a common challenge.

The most successful implementations align tool choice with team size, workflow complexity, and integration needs rather than brand recognition.

Closing Perspective

The Best Software Tools for Managing Customer Relationships are not defined by market share alone. They succeed when they fit naturally into daily work, reduce friction, and support consistent customer experiences.

In 2026, CRM software is less about managing contacts and more about managing context. Businesses that choose tools aligned with their actual processes tend to see faster adoption, clearer insights, and more sustainable returns.

Post Comment

Be the first to post comment!