In an AI tooling market flush with capital and competition, one startup is gaining serious investor attention—not for its flashy interface, but for its surgical focus on code intelligence.

According to multiple sources cited by TechCrunch and Bens Bites, Greptile, an AI code review company founded in 2023, is in advanced talks with Benchmark to lead a $30 million Series A round. The round could value the company at $180 million post-money.

This puts Greptile squarely on the radar of institutional investors looking for early-stage winners in the AI developer tools arms race.

Greptile’s Play: Less Autocomplete, More Accountability

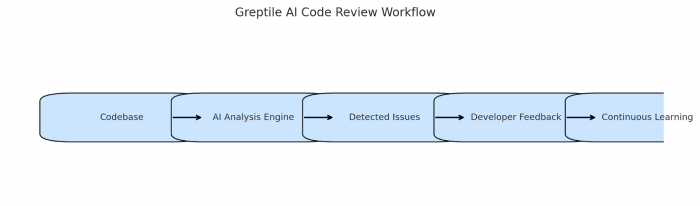

While many generative AI coding assistants aim to help you write code faster, Greptile is focused on making sure that code is secure, maintainable, and production-ready. It acts less like a Copilot and more like a CTO—with a deep memory of your entire codebase.

That emphasis on review, audit, and traceability over sheer generation speed is what sets the company apart.

Behind the Term Sheet: Benchmark’s Calculus

Benchmark partner Eric Vishria is reportedly leading the round. The firm, known for early bets on Docker, Elastic, and Confluent, tends to back foundational infrastructure startups early in their lifecycle.

Why now?

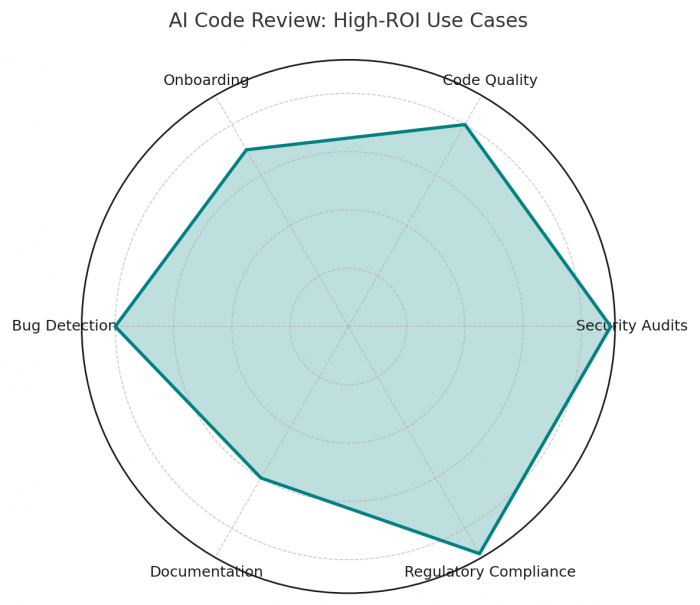

- Timing: The need for AI governance is rising as more teams move toward AI-assisted development workflows.

- Category clarity: AI code review is distinct from code generation—a different wedge with different defensibility.

- Founder conviction: Greptile CEO Daksh Gupta has been vocal about extreme execution intensity, likening 95% effort to 0%.

The Market Is Not Empty

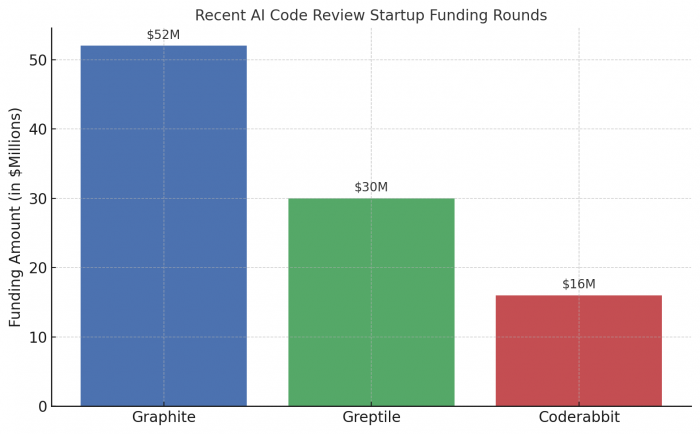

Greptile isn’t building in a vacuum. Rivals are already stacked:

| Company | Recent Round | Investors |

| Graphite | $52M Series B | Accel, Anthropic, a16z, Menlo Ventures |

| Coderabbit | $16M Series A | CRV |

| Greptile | $30M (pending) | Benchmark (in talks) |

These companies are all betting on code review and secure CI/CD pipelines as the “second wave” of AI in development.

The Culture Question

In contrast to rivals, Greptile’s internal pace is attracting attention—and not just praise.

According to comments made by Gupta and shared by TechCrunch, the team works “9am to 11pm, six or seven days a week.” This may resonate with investors prioritizing execution speed, but raises questions about long-term team scalability.

Is a sprint culture sustainable when code review demands precision, iteration, and context?

What’s at Stake

A Series A at a $180 million valuation is far from typical in today’s startup environment.

For that to make sense, Greptile must:

- Prove product-market fit across mid- and large-scale teams

- Build a defensible codebase understanding AI

- Demonstrate real reductions in engineering risk

This isn’t about productivity—it’s about liability, compliance, and engineering trust.

Timeline: How Fast Is Too Fast?

| Date | Milestone |

| 2023 | Founded by Daksh Gupta |

| 2024 | Joined Y Combinator |

| Mid 2024 | Raised $4M seed (Initialized) |

| July 2025 | In talks for $30M Series A |

Greptile’s trajectory is steep. From YC to triple-digit valuation in under two years? Rare—but not unheard of in this category.

Signal or Noise?

Investors following this story should ask:

- Is Greptile building a system, or just wrapping OpenAI calls in a layer of UX?

- Are enterprises ready to trust AI with code reviews beyond linting and security scans?

- What happens when GitHub or Amazon move into this exact category?

Because the core risk isn’t whether the tech works—it’s whether dev teams will change how they ship code.

Final Word

Greptile’s pending Series A—led by Benchmark, if finalized—will put the startup in rare company. Not because of how much it’s raised, but because of what it’s promising: not just to write your code faster, but to check it with a memory of every pull request, every commit, every line.

If that vision proves real, the $180M valuation might not just be rational—it might be conservative.

Post Comment

Be the first to post comment!