On This Page

- 1. AI-Powered Invoice Capture and Data Extraction

- 2. Intelligent Workflow Automation

- 3. Three-Way Matching with Exception Intelligence

- 4. Fraud Detection and Anomaly Monitoring

- 5. Embedded Payments and ERP Integration

- 6. Real-Time Analytics and Cash Flow Visibility

- 7. Vendor Self-Service Portals

- Final Thoughts: What Really Matters in 2026

Accounts payable has quietly become one of the most strategic functions inside modern finance teams. In 2026, AP is no longer just about paying bills on time. It sits at the intersection of cash flow management, fraud prevention, compliance, and operational efficiency. As invoice volumes grow and vendor ecosystems stretch across borders, manual processes simply do not scale.

What makes this shift more important is that not all AP software is created equal. Many platforms advertise automation, but only a handful of features truly move the needle. Some are transformational. Others sound impressive but deliver limited real-world value.

Below are the seven most essential accounts payable software features for 2026, ranked and rated out of five stars based on practical impact, maturity, and long-term usefulness. Not everything earns a perfect score, and that is intentional.

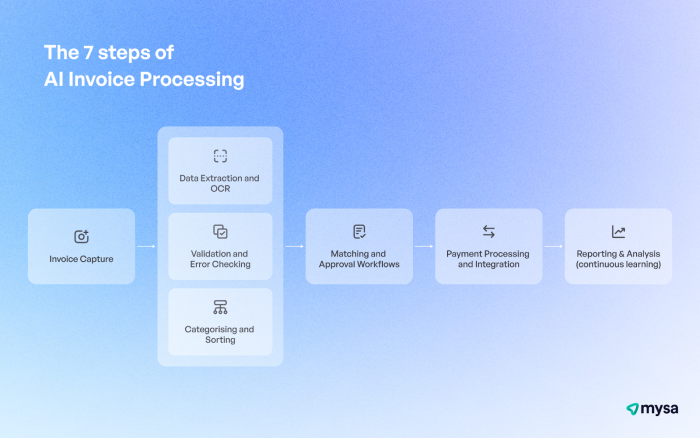

1. AI-Powered Invoice Capture and Data Extraction

Rating: ⭐⭐⭐⭐⭐ (5/5)

If there is one feature that defines modern AP, this is it.

AI-driven invoice capture uses intelligent document processing to read invoices from emails, PDFs, scans, and portals with near-human accuracy. In mature systems, extraction accuracy consistently reaches 93 to 98 percent, even when vendors use inconsistent layouts or languages.

What elevates this feature in 2026 is context awareness. The software does not just extract numbers. It understands vendor history, typical line items, tax behavior, and coding patterns. This allows auto-coding of GL accounts and dramatically reduces human review.

This feature earns a full five stars because it eliminates the single biggest cost driver in AP: manual data entry.

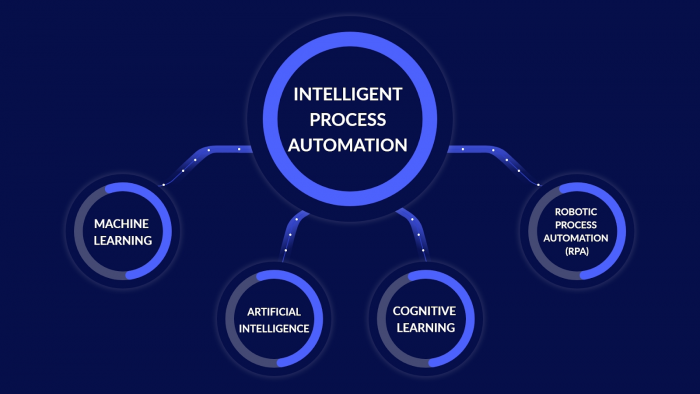

2. Intelligent Workflow Automation

Rating: ⭐⭐⭐⭐☆ (4/5)

Workflow automation determines how quickly invoices move from intake to payment. In 2026, the best systems route invoices dynamically based on amount, risk level, department, vendor type, and historical behavior.

Approvals can be delegated automatically, escalated when delays occur, and completed from mobile devices. Embedded comments replace long email threads, creating a clean audit trail directly on the invoice.

This feature earns four stars instead of five for one reason: workflows are only as good as the rules behind them. Poor configuration can still create bottlenecks. When implemented well, however, this feature routinely cuts cycle times by 30 percent or more.

3. Three-Way Matching with Exception Intelligence

Rating: ⭐⭐⭐⭐⭐ (5/5)

Matching invoices to purchase orders and goods receipts is foundational, but in 2026 it has become far more nuanced.

Modern AP platforms support three-way and four-way matching with tolerance thresholds, partial receipts, and intelligent exception handling. Instead of stopping an invoice for minor discrepancies, the system understands acceptable variance and flags only true anomalies.

This feature earns five stars because it directly prevents overpayments and fraud while allowing AP teams to process high volumes without drowning in false exceptions. It is a quiet but powerful control mechanism.

4. Fraud Detection and Anomaly Monitoring

Rating: ⭐⭐⭐⭐☆ (4/5)

Fraud in accounts payable is evolving, and software has had to keep up. In 2026, leading platforms use behavioral analysis, duplicate detection, and statistical models such as Benford’s Law to identify suspicious activity before payments are released.

Common red flags include unusual invoice amounts, sudden vendor bank changes, duplicate submissions, and off-hours activity. Some systems also enforce mandatory reviews for sensitive changes.

This feature earns four stars because while detection has improved significantly, it still depends on clean data and disciplined follow-up. It is powerful, but not foolproof.

5. Embedded Payments and ERP Integration

Rating: ⭐⭐⭐⭐⭐ (5/5)

Accounts payable software should not end at approval. In 2026, the strongest platforms embed payments directly into the workflow.

Support for ACH, wires, virtual cards, and international rails allows finance teams to control timing, capture early payment discounts, and reduce reconciliation work. Real-time, bi-directional integration with ERP systems ensures that approvals, payments, and ledger updates stay aligned.

This feature earns five stars because it closes the loop. It reduces month-end close times, improves cash visibility, and removes the need for disconnected banking processes.

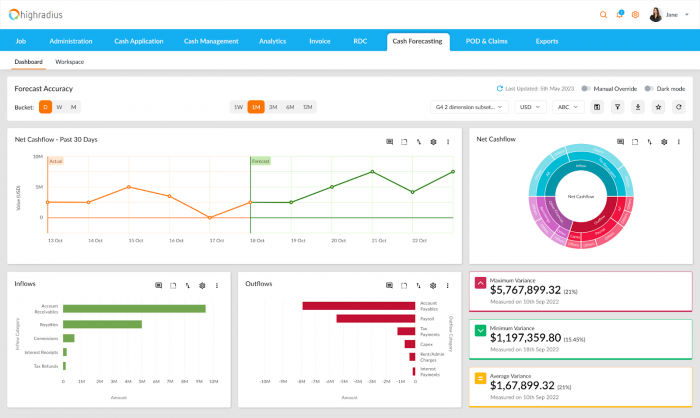

6. Real-Time Analytics and Cash Flow Visibility

Rating: ⭐⭐⭐⭐☆ (4/5)

Analytics has shifted AP from a back-office function to a strategic input. Dashboards now track Days Payable Outstanding, processing costs, exception rates, and vendor spend in real time.

More advanced platforms layer predictive analytics on top, forecasting future cash outflows and identifying vendor risk trends. This turns AP data into planning intelligence rather than historical reporting.

This feature earns four stars because while insights are valuable, they only matter if leadership actually uses them. The technology is strong, but adoption varies by organization.

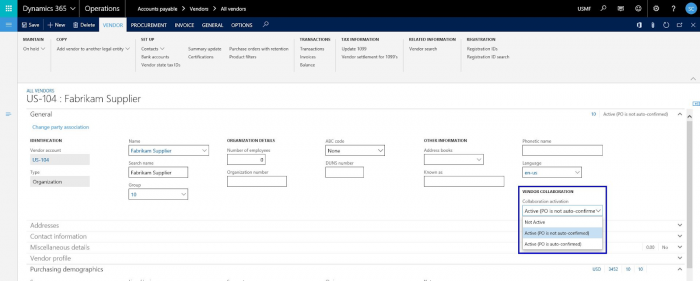

7. Vendor Self-Service Portals

Rating: ⭐⭐⭐☆☆ (3/5)

Vendor portals allow suppliers to submit invoices, check payment status, and manage banking details without contacting AP teams. In theory, this reduces inbound inquiries and improves vendor satisfaction.

In practice, adoption is uneven. Some vendors embrace portals. Others continue emailing PDFs regardless of instructions.

This feature earns three stars. It is helpful, especially at scale, but its value depends heavily on vendor compliance and change management rather than software capability alone.

Final Thoughts: What Really Matters in 2026

Accounts payable software has reached a point where automation alone is no longer a differentiator. The real value lies in intelligence, integration, and control.

The highest-performing AP teams in 2026 are not chasing every feature. They focus on the ones that eliminate friction, reduce risk, and surface insight. AI-driven invoice capture and intelligent matching form the foundation. Payments, analytics, and fraud controls build on top of it.

Before choosing a platform, finance leaders should ask a simple question: does this system reduce effort, or just rearrange it?

The best accounts payable software does not just process invoices faster. It changes how finance teams see their role, from transactional operators to strategic stewards of cash and risk.

Post Comment

Be the first to post comment!